In scalping, every second is important, especially when it comes to trading with a 1-minute timeframe. Consequently, market participants, using one-minute strategies for FX, traders might consider executing most of their trades with the most popular pairs.Īvoiding the use of stop-loss and take-profit orders Here it might also be helpful to point out that most liquid major currency pairs typically have better spreads, than their less famous counterparts. For such a short timeframe as 1 minute, a trader might be only aiming at 5 or 10 pip gain, therefore brokers having tight spreads is essential for success in this style of trading. Fortunately, there are plenty of brokers who do not charge commissions for trading.Īnother major consideration here is the size of the spreads. Therefore, those types of expenses can easily add up to an extent where a trader could be spending $100 to $500 just in commissions, which can significantly reduce his or her potential payouts. The successful Forex strategy on the 1-minute timeframe relies on dozens of trades per day. Some providers do charge a $5 or $10 fee for trading 1 lot, which is the equivalent of 100,000 units of a given currency. Firstly, it is important to avoid commissions. Let us go through each of those methods in more detail.īefore moving on to the exact methods, it is important to mention that before traders start using one-minute strategies for Forex, it might be useful to consider broker expenses.

Many experienced traders who are using scalping strategy do prefer to open and close positions manually because in this style every second can be very valuable.

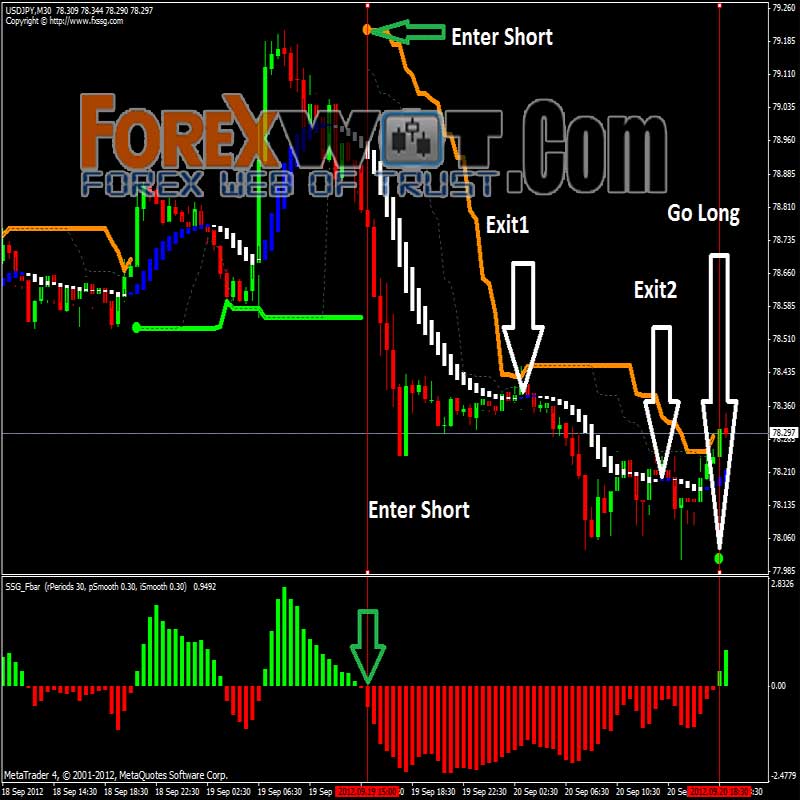

Since we are talking about such a short timeframe, it is essential to save as much money on those expenses as possible. Firstly, before even beginning the trading process, it is essential to find brokers with no commissions per trade and with competitive spreads. We will discuss 5 essential, yet very simple strategies that such market participants can employ. However, there are many traders who might prefer to close their positions in around 60 seconds, instead of waiting for one-quarter of an hour or more. 80% -90% profitable signals are actually not needed to be profitable which is what users find when they load it on chart.The Forex scalping trading style typically involves trades with a 1 to the 15-minute timeframe. What I'm suggesting and believing here is "If future data have some dependency with past data" then TRADE EXTRACTER should need to work. The algorithm does what it built for but being profitable is still a problem based on human greediness.Įarly users of trade extractor, misunderstood it and thought it as an holy-grail or magic wand which in-turn quickly reflected it in bad reviews. So, there must to be a logic behind every successful trades. The reason for that is there are n number of price action traders, scalpers, swing traders they use price and technical indicators for making decisions. Since I believed that there is possible tendency of historical data that could affect the future data. I enjoyed building an Native Self learning algorithm which quickly decodes the given historical data and show the best entry points that could potentially be a profitable trades. I developed TRADE EXTRACTOR as an support tool for my trade decision. Read till the End !! Surely It'll be useful

0 kommentar(er)

0 kommentar(er)